Because it is wonderful. /discussionCadence (post: 1482966) wrote:So, I decided to give Tiger & Bunny a chance...because a favorite manga-ka of mine was tweeting about it (stupid reason, I know). Much to my surprise, and despite the numerous reasons I would normally hate it (which I was actively listing in my head as I was watching), I find it oddly lovable. I have absolutely no idea why.

April showers bring [Spring 2011] anime

-

TheSubtleDoctor - Posts: 1838

- Joined: Mon Dec 14, 2009 7:48 am

- Location: Region 1

Cadence (post: 1482966) wrote: . . . I find it oddly lovable. I have absolutely no idea why.

I don't know about you, but Kotetsu/Tiger was the main reason I kept watching Tiger & Bunny at first. He's just the sweetest, most idealistic hero I could imagine. He loves his family and never seems to get a break. It'd be hard NOT to root for him.

I was behind a week, and finally got caught up, and I have to say that the show is getting more and more interesting.

[spoiler] The mad bears were AWESOME! I literally laughed out loud. [/spoiler]

- Mouse2010

- Posts: 348

- Joined: Fri Jan 14, 2011 5:44 pm

- Location: western US

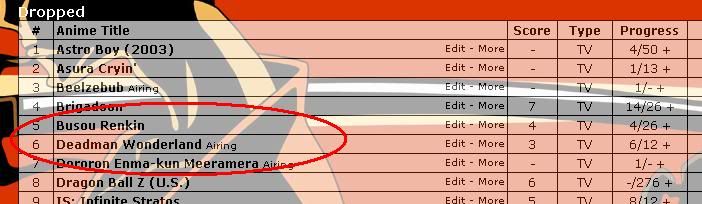

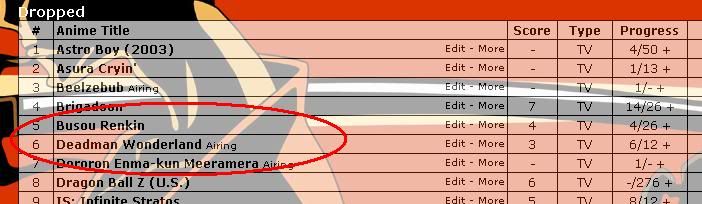

Realization about Deadman Wonderland: I just don't care anymore.

Mr. HatNClogs wrote:Fish is right again

-

TheSubtleDoctor - Posts: 1838

- Joined: Mon Dec 14, 2009 7:48 am

- Location: Region 1

ops: Lol, Doc. This is good to know, I now feel less awful for ditching! Woohoo! And normally I'll stick through 12-episode series. Aw well...

ops: Lol, Doc. This is good to know, I now feel less awful for ditching! Woohoo! And normally I'll stick through 12-episode series. Aw well...

Loving Hanasaku Iroha. So, so very much.

-

MightiMidget - Posts: 754

- Joined: Mon Nov 30, 2009 12:10 pm

- Location: @nevermorelit

Man, so the first nine episodes of Dog Days were pretty much mindless entertainment, but episode ten was actually good, without being like, "Well, this is fun but ultimately kind of average" but I thought episode ten was pretty awesome.

-

Mr. Hat'n'Clogs - Posts: 2364

- Joined: Sun Apr 19, 2009 2:16 pm

- Location: The Roaring Song-City

I've been thinking about how the financial system actually operates compared to how it works in C.

You've got the whole Midas money thing. When the value of that evil money disappears, so does anything that it's used for, which makes sense and is kind of an abrupt, accelerated version of what would happen anyway. Of course, functionally, that isn't too far off from how real money actually works, since it's really only the perceived value of that money that gives it any value. Once that value's gone, well, you've got a stack of paper. Technically, governments give it value by fiat, but no one will want it if your market goes down the tubes.

The more interesting thing is that the financial system in the real world is already kind of decided by the whims of Pokemon battles. Much of the activity on the stock market today has very little human agency. Most of the trades are done by algorithms, which suck in a huge amount of data, analyse it in real-time to try and predict trends, and make trades in real-time based on the slightest anticipation of movement. And since everyone is using these algorithms, they kind of respond to each others' trades and end up trying to outsmart and outmaneuver each other. So these algorithms that are constantly fighting with each other can be considered the Pokemon.

The thing with algorithmic trading is that algorithms look at the market in a fundamentally different way than humans do. Because they're able to analyse huge amounts of data in an instant, they're able to detect trends that people can't. Combined with the interactions with other algorithms, the results look ridiculously chaotic since humans can only see broad trends. I mean, from our point of view, the outcomes of the algorithms and a Pokemon battle are essentially the same in that we give it broad parameters to function in and then it's largely out of our control as they hit each other and spit fire or something.

As a side illustration of just how fundamental algorithms are to the financial sector, I'll note that algorithmic trading is one of the reasons why New York City doesn't have a huge tech industry like Silicon Valley. All of the computer scientists and software engineers that would have worked in NYC's tech industry have all been poached by firms in the city's powerful financial sector. These firms can afford to pay ridiculous sums of money for these guys and is much more than what the tech industry offers, and as a result, tech never developed as much as it could have there.

You've got the whole Midas money thing. When the value of that evil money disappears, so does anything that it's used for, which makes sense and is kind of an abrupt, accelerated version of what would happen anyway. Of course, functionally, that isn't too far off from how real money actually works, since it's really only the perceived value of that money that gives it any value. Once that value's gone, well, you've got a stack of paper. Technically, governments give it value by fiat, but no one will want it if your market goes down the tubes.

The more interesting thing is that the financial system in the real world is already kind of decided by the whims of Pokemon battles. Much of the activity on the stock market today has very little human agency. Most of the trades are done by algorithms, which suck in a huge amount of data, analyse it in real-time to try and predict trends, and make trades in real-time based on the slightest anticipation of movement. And since everyone is using these algorithms, they kind of respond to each others' trades and end up trying to outsmart and outmaneuver each other. So these algorithms that are constantly fighting with each other can be considered the Pokemon.

The thing with algorithmic trading is that algorithms look at the market in a fundamentally different way than humans do. Because they're able to analyse huge amounts of data in an instant, they're able to detect trends that people can't. Combined with the interactions with other algorithms, the results look ridiculously chaotic since humans can only see broad trends. I mean, from our point of view, the outcomes of the algorithms and a Pokemon battle are essentially the same in that we give it broad parameters to function in and then it's largely out of our control as they hit each other and spit fire or something.

As a side illustration of just how fundamental algorithms are to the financial sector, I'll note that algorithmic trading is one of the reasons why New York City doesn't have a huge tech industry like Silicon Valley. All of the computer scientists and software engineers that would have worked in NYC's tech industry have all been poached by firms in the city's powerful financial sector. These firms can afford to pay ridiculous sums of money for these guys and is much more than what the tech industry offers, and as a result, tech never developed as much as it could have there.

-

blkmage - Posts: 4529

- Joined: Mon May 03, 2004 5:40 pm

I'm pretty sure I know how Ano Hana will end at this point, but otherwise, I wasn't as huge a fan of this episode. Normally each episode ends with my feeling really happy or really wanting to see the next episode, but this one was kind of "Well, that was all right, I guess."

-

Mr. Hat'n'Clogs - Posts: 2364

- Joined: Sun Apr 19, 2009 2:16 pm

- Location: The Roaring Song-City

Just dropped Aria. I seriously enjoyed it when it wasn't being tacky, but. . . got like. Two minutes into the most recent episode and...had enough.  ops:

ops:

ops:

ops:-

MightiMidget - Posts: 754

- Joined: Mon Nov 30, 2009 12:10 pm

- Location: @nevermorelit

I was watching STEINS;GATE and I realized that I'd never seen the game CGs before. Since huke did the art for it, I was curious and looked it up. And then I was sad, because the CGs look so much better than the anime. I mean, obviously, no anime is going to look like huke's art, but I might look into playing it for that.

-

blkmage - Posts: 4529

- Joined: Mon May 03, 2004 5:40 pm

Wow, the only anime I am watching from this list is STEINS;GATE. I think it's really cool, so far. Very interesting, intense, and also...hilarious! It's based in the same universe as another anime?? I might need to check that out sometime...

"For what use is there in praying if you will only hear what you want to hear." - As I Lay Dying *The Sound Of Truth*

Let's make an AMV together!

Kokoro no Uta The thoughts of an aspiring mangaka (yeah...this is my blog >.>)

Ooh look! I have fanfiction! YAY!!!!!!!

http://www.fanfiction.net/~sevencandlesticks

If you like Tsubasa and Cardcaptors, then you might like what I've written (if I didn't slaughter the series... XD)

He heals the brokenhearted and binds up their wounds - Pslam 147:3

Let's make an AMV together!

Kokoro no Uta The thoughts of an aspiring mangaka (yeah...this is my blog >.>)

Ooh look! I have fanfiction! YAY!!!!!!!

http://www.fanfiction.net/~sevencandlesticks

If you like Tsubasa and Cardcaptors, then you might like what I've written (if I didn't slaughter the series... XD)

He heals the brokenhearted and binds up their wounds - Pslam 147:3

-

AnimeGirl - Posts: 1053

- Joined: Wed Nov 11, 2009 5:51 pm

- Location: California

Erm. I only watched the first episode of Chaos;Head, but I think it was fairly tacky. :6: Granted, it was an "oops, this isn't Night Head Genesis?" watching. And I was more sensitive then...(is this a bad sign?)

But I'm enjoying Steins;Gate too! It got awesome points for its Back to the Future reference. B)

But I'm enjoying Steins;Gate too! It got awesome points for its Back to the Future reference. B)

-

MightiMidget - Posts: 754

- Joined: Mon Nov 30, 2009 12:10 pm

- Location: @nevermorelit

I'm staring blankly at the last episode of C and vaguely following, I think, what might be going on. Blkmage's blurp a few posts up helped, though economics has never been my strong point...at all. Hmmm...

-

MightiMidget - Posts: 754

- Joined: Mon Nov 30, 2009 12:10 pm

- Location: @nevermorelit

Caught up on Tiger & Bunny and Blue Exorcist. I had really liked episode 10 of Tiger & Bunny , but episode 11 bored me for some reason, right up until the bit after the credits, when things suddenly got . . . interesting. Now I'm really looking forward to the next episode.

- Mouse2010

- Posts: 348

- Joined: Fri Jan 14, 2011 5:44 pm

- Location: western US

Time for more macroeconomics with C!

So it's been revealed that for whatever reason, there's a wave of bad stuff moving through the markets and is about to hit Japan. Interestingly enough, that's kind of similar to how our very own economic shenanigans occurred circa 2008, with those bad subprime loans in the US poisoning the rest of the worlds' markets. So how did the world fight against this wave and stop countries from disappearing?

In C, Mikuni starts up a Cthulhu-like beating heart thing in Japan's financial district which has the effect of injecting tons of Midas money into the system. In the real world, the governor of a country's central bank will similarly just start injecting money into the system, at least they should if they subscribe to Keynesian economics. Since every modern economy uses fiat money, the central bank can technically just create as much money as it wants.

The problem that comes is inflation. In extreme cases, you end up having so much money that it becomes worthless. Typical examples are German marks in the early 1920s and the Zimbabwean dollar today. In the general case, prices of things rise and your economy can start to slow down. In C, you hear them talk about trading the future to save the present and this is what they're alluding to: the possibility of wrecking the economy in the future to save the economy in the present.

It remains to be seen what the conclusion of the show is, but obviously, things are different from the way they're presented in C. Unlike in C, inflation isn't some irreversible horror that should be avoided at all costs. In fact, as far as I understand, zero inflation monetary policy has been tried and didn't work out so well. Anyhow, the idea behind expansionary monetary policy is to jumpstart the economy and eventually make it grow at a rate faster than inflation rises, so you won't end up with the nasty effects of high inflation. This idea seems to be absent from the presentation in C.

Of course, I'm most familiar with monetary policy as it's been conducted in Canada and, to a lesser extent, Europe and the US. But C is a Japanese cartoon, so I'd imagine the whole debacle with the Lost Decade (the 1990s) plays in to the narrative somehow, because there's a lot of rhetoric that it kind of shares with Eden of the East.

So it's been revealed that for whatever reason, there's a wave of bad stuff moving through the markets and is about to hit Japan. Interestingly enough, that's kind of similar to how our very own economic shenanigans occurred circa 2008, with those bad subprime loans in the US poisoning the rest of the worlds' markets. So how did the world fight against this wave and stop countries from disappearing?

In C, Mikuni starts up a Cthulhu-like beating heart thing in Japan's financial district which has the effect of injecting tons of Midas money into the system. In the real world, the governor of a country's central bank will similarly just start injecting money into the system, at least they should if they subscribe to Keynesian economics. Since every modern economy uses fiat money, the central bank can technically just create as much money as it wants.

The problem that comes is inflation. In extreme cases, you end up having so much money that it becomes worthless. Typical examples are German marks in the early 1920s and the Zimbabwean dollar today. In the general case, prices of things rise and your economy can start to slow down. In C, you hear them talk about trading the future to save the present and this is what they're alluding to: the possibility of wrecking the economy in the future to save the economy in the present.

It remains to be seen what the conclusion of the show is, but obviously, things are different from the way they're presented in C. Unlike in C, inflation isn't some irreversible horror that should be avoided at all costs. In fact, as far as I understand, zero inflation monetary policy has been tried and didn't work out so well. Anyhow, the idea behind expansionary monetary policy is to jumpstart the economy and eventually make it grow at a rate faster than inflation rises, so you won't end up with the nasty effects of high inflation. This idea seems to be absent from the presentation in C.

Of course, I'm most familiar with monetary policy as it's been conducted in Canada and, to a lesser extent, Europe and the US. But C is a Japanese cartoon, so I'd imagine the whole debacle with the Lost Decade (the 1990s) plays in to the narrative somehow, because there's a lot of rhetoric that it kind of shares with Eden of the East.

-

blkmage - Posts: 4529

- Joined: Mon May 03, 2004 5:40 pm

HanaIro episode eleven had kind of a b'awwww ending to it, probably the biggest b'aww the show has had.

-

Mr. Hat'n'Clogs - Posts: 2364

- Joined: Sun Apr 19, 2009 2:16 pm

- Location: The Roaring Song-City

-

MightiMidget - Posts: 754

- Joined: Mon Nov 30, 2009 12:10 pm

- Location: @nevermorelit

Spring is ending!

C held great promise at the beginning and it seemed to be trying to play around with some interesting ideas. Unfortunately, most of the execution fell flat. The characters were uninteresting and the plot was incoherent. There were some interesting parallels to economics, but quite honestly, I think those were lucky accidents, because there are just as many lolwut economic parallels if you think too hard about certain things. Overall, I'm left not quite knowing what this show was trying to say, which is pretty unacceptable for a show that was banking (lol) on being thought-provoking.

Ano Hana (or "Ano Hi Mita Hana no Namae o Boku-tachi wa Mada Shiranai", or "We still don't know the name of the flower we saw that day", or "We still don't know the name of the anime we watched that day", or "Dat Flower") turned out pretty well. I don't think I saw many of the big twists coming and this staff is pretty good at making previously unlikable characters sympathetic. I think my biggest problem pertains to the interactions of a certain character and how they exploited that waaaay too late in the show. Other than that minor hangup, the ending was excellent, which is not something you can say about many shows. A very good show.

C held great promise at the beginning and it seemed to be trying to play around with some interesting ideas. Unfortunately, most of the execution fell flat. The characters were uninteresting and the plot was incoherent. There were some interesting parallels to economics, but quite honestly, I think those were lucky accidents, because there are just as many lolwut economic parallels if you think too hard about certain things. Overall, I'm left not quite knowing what this show was trying to say, which is pretty unacceptable for a show that was banking (lol) on being thought-provoking.

Ano Hana (or "Ano Hi Mita Hana no Namae o Boku-tachi wa Mada Shiranai", or "We still don't know the name of the flower we saw that day", or "We still don't know the name of the anime we watched that day", or "Dat Flower") turned out pretty well. I don't think I saw many of the big twists coming and this staff is pretty good at making previously unlikable characters sympathetic. I think my biggest problem pertains to the interactions of a certain character and how they exploited that waaaay too late in the show. Other than that minor hangup, the ending was excellent, which is not something you can say about many shows. A very good show.

-

blkmage - Posts: 4529

- Joined: Mon May 03, 2004 5:40 pm

I have thought this pretty much the whole season.blkmage (post: 1486752) wrote:There were some interesting parallels to economics, but quite honestly, I think those were lucky accidents

-

TheSubtleDoctor - Posts: 1838

- Joined: Mon Dec 14, 2009 7:48 am

- Location: Region 1

Finally started watching Ano Hana- just in time for the Summer Season. I'm planning on finishing it before the new anime starts airing. Great anime, though. I'm thoroughly enjoying it.

Debating on picking up Tiger and Bunny. I'm not fond of Mech, so it really needs strong characters and storyline to back it up.

I think HanaIro and AnoHana are my faves for this, though.

Debating on picking up Tiger and Bunny. I'm not fond of Mech, so it really needs strong characters and storyline to back it up.

I think HanaIro and AnoHana are my faves for this, though.

-

Atria35 - Posts: 6295

- Joined: Sat Mar 20, 2010 7:30 am

You really should as its quite excellent. There aren't really mecha, two of the super heroes wear power suits, but the rest do not. Characterization is one of the show's strong points, so all signs point to yes.Atria35 (post: 1486927) wrote:Debating on picking up Tiger and Bunny. I'm not fond of Mech, so it really needs strong characters and storyline to back it up.

-

TheSubtleDoctor - Posts: 1838

- Joined: Mon Dec 14, 2009 7:48 am

- Location: Region 1

So I think I realized the thing about C is that I don't care. [spoiler]When Sato died, I just didn't care.[/spoiler]That was my favorite character.

It especially pales in comparison to Ano Hi Mita Hana no Namae wo Bokutachi wa Mada Shiranai. About three episodes in this was already my favorite show of the season, but that stunning finale made it easily a great show. I expected a good send off, but I didn't expect it to be that good. I guess I should go watch Honey and Clover II now, huh.

It especially pales in comparison to Ano Hi Mita Hana no Namae wo Bokutachi wa Mada Shiranai. About three episodes in this was already my favorite show of the season, but that stunning finale made it easily a great show. I expected a good send off, but I didn't expect it to be that good. I guess I should go watch Honey and Clover II now, huh.

-

Mr. Hat'n'Clogs - Posts: 2364

- Joined: Sun Apr 19, 2009 2:16 pm

- Location: The Roaring Song-City

Ano Hana ending spoilers:

Well it's not really the anime itself but what I'm thinking of pertains to the anime.

Sad story warning.

[spoiler]So two friends of mine went to Mozambique for a holiday. A lot of the country is a landmine riddled wasteland but it also has some of the most utterly beautiful beaches in the world. For much less than it would normally cost you could go to a genuine beach paradise for a week or two. So two of my friends went.

And only one came back. They were out swimming, and the current was treacherous and strong.

Later we heard the full story, how the friend who was lost grabbed onto the one who wasn't, begging for help, but got shoved off in fear and panic.

For a brief while he was on every legal drug known to man, trying to cope... and then he turned to the illegal ones and almost destroyed his own life trying to run from his guilt.

I guess what I'm saying is I get Poppo, more than I'd like to. That is one hell of a thing to carry while so young, and on your own.[/spoiler]

Well it's not really the anime itself but what I'm thinking of pertains to the anime.

Sad story warning.

[spoiler]So two friends of mine went to Mozambique for a holiday. A lot of the country is a landmine riddled wasteland but it also has some of the most utterly beautiful beaches in the world. For much less than it would normally cost you could go to a genuine beach paradise for a week or two. So two of my friends went.

And only one came back. They were out swimming, and the current was treacherous and strong.

Later we heard the full story, how the friend who was lost grabbed onto the one who wasn't, begging for help, but got shoved off in fear and panic.

For a brief while he was on every legal drug known to man, trying to cope... and then he turned to the illegal ones and almost destroyed his own life trying to run from his guilt.

I guess what I'm saying is I get Poppo, more than I'd like to. That is one hell of a thing to carry while so young, and on your own.[/spoiler]

Blessed be the LORD my strength which teacheth my hands to war, and my fingers to fight:

My goodness, and my fortress; my high tower, and my deliverer; my shield, and he in whom I trust; who subdueth my people under me.

神はそのひとり子を賜わったほどに、この世を愛して下さった。それは御子を信じる者がひとりも滅びないで、永遠の命を得るためである.

My MAL Profile. Please check out my Dad's Christian eBook on Facebook.

-

Falx - Posts: 590

- Joined: Tue Nov 10, 2009 4:05 am

- Location: South Africa

@Falx --

[spoiler] I am sorry for your friends. Both of them. I hope he is doing a bit better today, and regardless I will be keeping him in my prayers. Never been in that position myself, so I can only imagine the burden. [/spoiler]

Anohana will probably never get watched again, but it definitely did not disappoint me. Just need to stop crying eventually.

[spoiler] I am sorry for your friends. Both of them. I hope he is doing a bit better today, and regardless I will be keeping him in my prayers. Never been in that position myself, so I can only imagine the burden. [/spoiler]

Anohana will probably never get watched again, but it definitely did not disappoint me. Just need to stop crying eventually.

-

MightiMidget - Posts: 754

- Joined: Mon Nov 30, 2009 12:10 pm

- Location: @nevermorelit

Dog Days cannot be construed as good by the usual quality metrics. The writing is pretty bad, the art ranges from okay to horrible off-model sakuga, and the characters are pretty one-note. However, it is certainly unintentionally hilarious and very cute.

TWGOK II is glorious and I believe the time is right to catch up on the manga.

TWGOK II is glorious and I believe the time is right to catch up on the manga.

-

blkmage - Posts: 4529

- Joined: Mon May 03, 2004 5:40 pm

That pretty much sums up Dog Days.blkmage (post: 1487626) wrote:Dog Days cannot be construed as good by the usual quality metrics. The writing is pretty bad, the art ranges from okay to horrible off-model sakuga, and the characters are pretty one-note. However, it is certainly unintentionally hilarious and very cute.

Also, C's ending was worse than I expected it to be.

-

Mr. Hat'n'Clogs - Posts: 2364

- Joined: Sun Apr 19, 2009 2:16 pm

- Location: The Roaring Song-City

Mr. Hat'n'Clogs (post: 1488291) wrote:Also, C's ending was worse than I expected it to be.

Yes.

I have little clue about what just happened, and I was fairly confused at the point it was trying to make anyways. 'Twas quite saddening...ah well...

I have little clue about what just happened, and I was fairly confused at the point it was trying to make anyways. 'Twas quite saddening...ah well...

Steins]Did not see that coming, for some reason. Now I could see it, but...killing off Mayuri? Sadness. But with time travel all deaths are possible to fix.[/spoiler]

-

MightiMidget - Posts: 754

- Joined: Mon Nov 30, 2009 12:10 pm

- Location: @nevermorelit

Hidan no Aria is poop.

Denpa Onna to Seishun Otoko was enjoyable, but the usual caveats with the whole animating only the first chunk of a long light novel series thing applies. I hear it could be getting a second season, which I think I'd like.

I found Gosick to be really varying in quality. There are some really, really good parts. These tend to deal with the characters and their personal story. There are some really dumb parts, mostly dealing with the random mysteries that the characters encounter. I don't know how I feel about the ending, because I know that there are two entire books that are supposed to happen after episode 22. I was hoping that the season would end with a movie covering the last book or something, but apparently not. The entire last episode was really weirdly vague about the events that occur.

And it looks like my spring season's done.

Denpa Onna to Seishun Otoko was enjoyable, but the usual caveats with the whole animating only the first chunk of a long light novel series thing applies. I hear it could be getting a second season, which I think I'd like.

I found Gosick to be really varying in quality. There are some really, really good parts. These tend to deal with the characters and their personal story. There are some really dumb parts, mostly dealing with the random mysteries that the characters encounter. I don't know how I feel about the ending, because I know that there are two entire books that are supposed to happen after episode 22. I was hoping that the season would end with a movie covering the last book or something, but apparently not. The entire last episode was really weirdly vague about the events that occur.

And it looks like my spring season's done.

-

blkmage - Posts: 4529

- Joined: Mon May 03, 2004 5:40 pm

Return to Anime and Anime Reviews

Who is online

Users browsing this forum: No registered users and 285 guests